Accountability in Climate Finance: Who Should Pay for Loss and Damage?

The UN Climate Change Conference in Baku highlighted the urgent need for a financial agreement to address climate loss and damage. Proposals for a Climate Damages Tax on major oil companies could generate significant funds to support vulnerable communities affected by climate crises. Activists are advocating for accountability from polluters, emphasizing the need for innovative solutions to finance climate action.

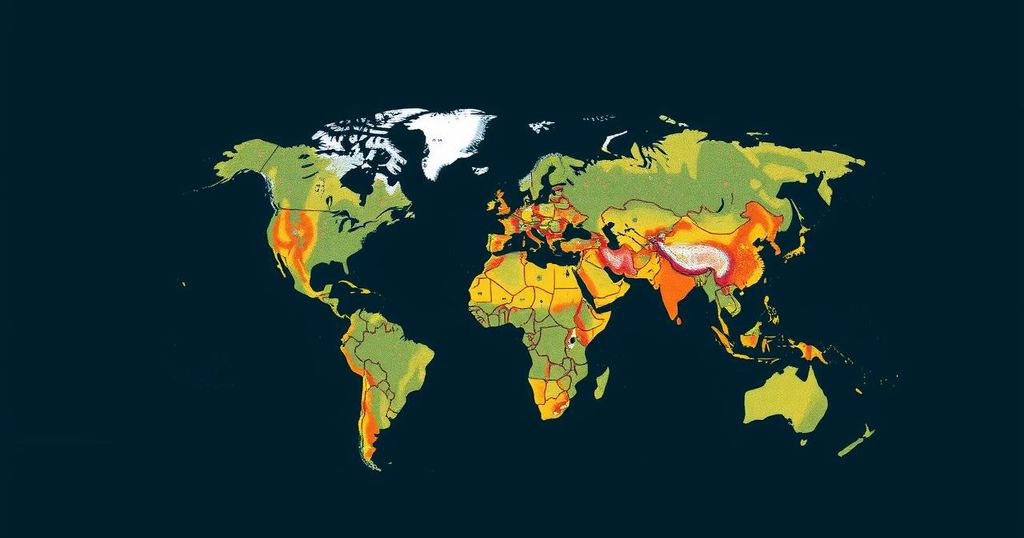

At the recent UN Climate Change Conference held in Baku (COP29), there was an urgent push for a climate financial agreement to address the escalating costs brought forth by the climate crisis, particularly affecting vulnerable communities globally. An analysis conducted by Greenpeace International and Stamp Out Poverty recommends a modest tax on the world’s seven largest oil and gas corporations, which could potentially augment the UN Fund for Responding to Loss and Damage by over 2000%. This fiscal strategy could also help mitigate the financial burdens stemming from significant weather incidents attributed to climate change, such as Hurricane Beryl and Typhoon Carina.

By implementing a Climate Damages Tax (CDT), we could generate vital resources for communities most impacted by severe climate events. The analysis indicates that taxing last year’s revenues from major oil companies, which amassed nearly US$150 billion, could significantly contribute to funds needed for recovery and adaptation. For instance, levies on ExxonMobil and Shell could cover substantial damages from major storms, illustrating how financial measures targeted at fossil fuel extraction can support climate justice.

Moreover, a comprehensive CDT strategy, particularly across affluent OECD nations, could yield an estimated US$900 billion by 2030, facilitating essential climate actions and bolstering governmental and community resilience in the face of climate impacts. This matter underscores a pressing need for innovative fiscal mechanisms that compel polluters of the climate crisis to bear the financial responsibility, rather than those disproportionately affected by its consequences.

The call for a climate damages tax comes at the conclusion of several weeks of activism, highlighting voices of those affected by environmental disasters. Activists have united with flood survivors to underscore the direct link between Big Oil’s practices and the misfortunes faced by communities worldwide. “To truly deliver climate justice, the numbers are never enough,” advocated Abdoulaye Diallo of Greenpeace International, emphasizing the time for accountability has arrived. Concerted global efforts are necessary to steer climate policy towards comprehensive accountability, ensuring those who contribute to the problem are held responsible for remedying the damages incurred.

In conclusion, as the implications of climate change intensify, the conversation surrounding accountability and compensation for climate loss and damage grows paramount. By endorsing solutions like the Climate Damages Tax, governments can effectively harness the financial means to confront the crisis, transitioning the burden of costs from those affected back onto the profit-generating entities responsible for exacerbating these environmental challenges.

The issue of financing climate loss and damages is becoming increasingly critical in the context of global climate negotiations. Vulnerable communities disproportionately bear the brunt of the climate crisis, facing severe weather events and environmental degradation. There is a growing consensus among environmental organizations and advocates that fossil fuel companies, which have historically contributed significantly to greenhouse gas emissions, ought to bear a financial responsibility for the damage caused. This discussion is currently gaining traction at major climate conferences, where the aim is to devise equitable funding mechanisms that prioritize justice for affected communities.

The proposal for a Climate Damages Tax emerges as a pivotal strategy to hold fossil fuel corporations accountable for their contribution to climate change. By implementing targeted taxation on profits and extraction, governments can generate essential funds to support communities facing climate-related adversities. Activations and advocacy for such fiscal measures underline the need for a paradigm shift in who bears the costs of climate impacts, reinforcing the principles of justice and accountability in climate policy.

Original Source: www.ipsnews.net