Divergent State Responses to Chinese Automaker Projects in the U.S.

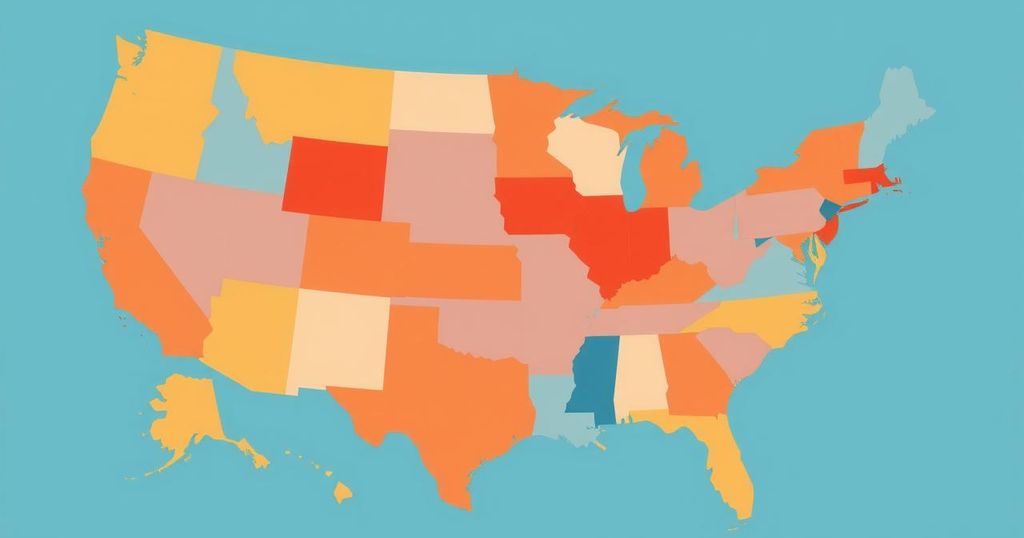

U.S. states exhibit a divided stance on welcoming Chinese automakers, weighing economic investment against national security concerns. Analysts predict growth in Chinese automotive manufacturing within the U.S., despite significant challenges, including regulations and market perception. While states like Michigan show some willingness to collaborate, others like Texas and South Carolina firmly reject any projects involving Chinese firms. The expanding Chinese EV market presents unique challenges and opportunities within the evolving landscape of U.S. automotive manufacturing.

U.S. states are experiencing a division in their openness to welcoming projects from Chinese automakers, weighing the potential for significant investments and job creation against national security concerns and public resistance. Industry analysts anticipate that a China-based automaker, in addition to existing entities like Volvo and Polestar, may commence manufacturing in the U.S. within the next several years. Increasing tariffs on Chinese vehicles may compel these automakers to assemble cars domestically, paralleling historical instances where Japanese and South Korean automakers established manufacturing within U.S. borders.

Colin Langan from Wells Fargo Securities indicated that state governors must consider their constituents’ job security, stating, “If you’re a governor of a state, as much as you might be anti-China, are you going to allow 5,000 people to be unemployed because you refuse to let the Chinese in?” Additionally, positions in the U.S. indicate potential for Chinese automakers looking to build new plants or purchase existing facilities.

President Trump has expressed a willingness to support the establishment of such businesses in the U.S., provided they employ American workers. Analysts suggest that partnerships with established automakers may be the preferred strategy for growth, as demonstrated by Chery Automobile and BYD’s initiatives in various countries. However, constructing a new plant remains capital-intensive and the Biden administration’s recent regulations may hinder incoming Chinese automakers.

The growth of the Chinese electric vehicle market continues, evidenced by models like BYD’s Seagull EV entering the market at competitive prices. Despite their potential, some U.S. states remain hesitant to partner with Chinese firms due to national security threats and current geopolitical dynamics. The Michigan Economic Development Corp. refrained from commenting on upcoming projects while recognizing existing Chinese collaboration.

In contrast, Republican states such as Texas and South Carolina have reportedly adopted staunch positions against facilitating ventures from Chinese companies, citing security concerns associated with the Chinese Communist Party. Conversely, New Mexico appears open to engaging with a Chinese automaker, emphasizing their lax economic development policies.

Several states, including Tennessee and Alabama, have expressed disinterest in supporting projects from Chinese firms, while New Jersey, Virginia, and others declined to comment on the issue. The possibility of repurposing shuttered assembly plants exists, though only a few remain operational. Given the current automotive market conditions, U.S. manufacturers are cautious about speculative partnerships due to lower than pre-pandemic vehicle purchase levels.

The discussions surrounding Chinese automakers delve into broader implications for the U.S. automotive sector, revealing differing state attitudes toward international partnerships and economic development strategies. As automakers navigate these complex relationships, the viability of attracting Chinese investments continues to evolve within this dual-leveled economic landscape.

The divide among U.S. states regarding the acceptance of Chinese automakers highlights the complex interplay between economic growth, job creation, and national security concerns. While some states display openness to partnerships that promise substantial investments, others firmly reject engagement with Chinese companies citing security issues. As various geopolitical factors influence decisions, the future of the U.S. market may witness diverse strategies adopted by states in response to prospective Chinese automotive investments.

Original Source: www.detroitnews.com