China’s Dominance in Global Battery Mineral Trade

In 2023, China dominated the global trade of battery minerals, accounting for 44% of imports and 58% of exports. Key minerals analyzed include lithium, graphite, and cobalt, with China holding substantial shares in production and processing. Increasing global demand for electric vehicles enhances the importance of these minerals, signaling China’s pivotal role in future energy technologies.

In the realm of global trade concerning battery minerals, China holds an unprecedented position, exercising control at numerous stages of the battery supply chain. Recent data from UN Comtrade reveals that, in 2023, China accounted for nearly 12 million short tons of battery-related mineral imports, which represents around 44% of the interregional trade. Furthermore, it exported close to 11 million short tons of battery materials, packs, and components, amounting to 58% of such trade, underscoring its dominance in this sector.

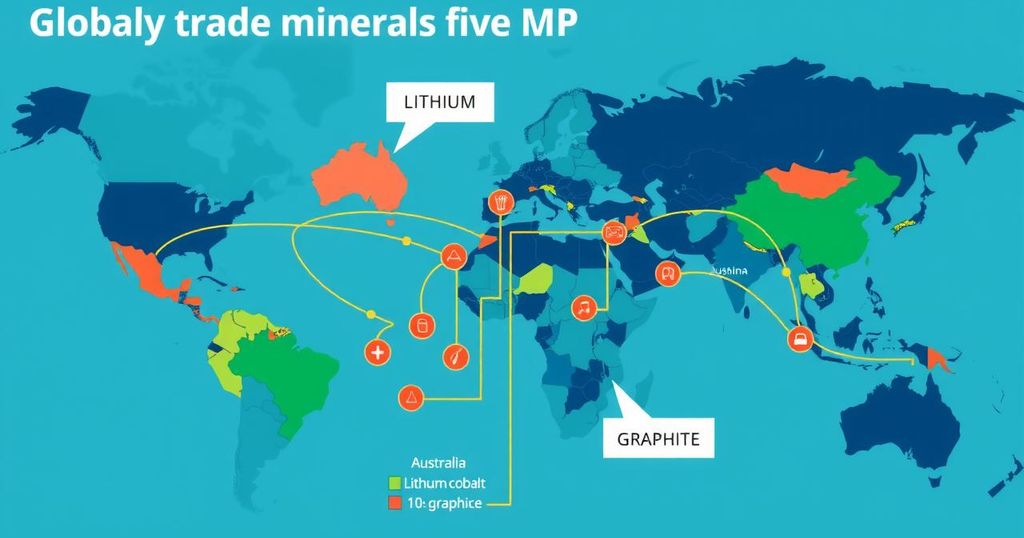

A closer look reveals the critical minerals involved in this trade: graphite, lithium, and cobalt. These minerals are essential for battery production and originate from both natural and synthetic sources. Consequently, they undergo various processing stages before being used to manufacture batteries and their components. With increasing global demand for electric vehicles and energy storage solutions, the significance of these minerals is magnified.

Lithium extraction methods typically include brine extraction as well as hard rock mining techniques. In 2023, China managed to produce roughly 18% of the world’s mined lithium, asserting its influence by controlling 25% of global lithium mining capacity. According to the National Geospatial-Intelligence Agency’s Tearline Project, Chinese firms have heavily invested in key mining operations in Argentina, securing a significant foothold in the so-called lithium triangle that encompasses Argentina, Bolivia, and Chile, which together contain about half of the world’s lithium.

China’s dominance extends to graphite as well, with domestic production representing a staggering 79% (approximately 1.27 million short tons) of the world’s natural graphite output in 2024. The U.S. Geological Survey noted that the United States, quite notably, produced none that year. On the cobalt front, Chinese companies command an impressive 80% of cobalt production in the Democratic Republic of the Congo, which is home to over half of the world’s cobalt supply.

Post-production, raw battery minerals get shipped globally for refining purposes. Illustrating this point, analysis indicates that China accounted for 46% of the globe’s raw battery mineral import trade in 2023. Australia, being the leading lithium producer, directed nearly all of its exports to China. Combined, China, Australia, and other regions in Asia and Oceania—including India and Japan—made up 71% of the worldwide raw battery mineral import trade that same year.

When it comes to processing, the figures are just as telling. China processes more than 90% of the world’s graphite, while, in 2022, its companies managed to hold over two-thirds of global processing capacity for both cobalt and lithium. That year, China also imported 20% of the world’s processed battery minerals, which predominantly consisted of cobalt sourced from Africa. However, a notable point in 2023 is China’s implementation of export restrictions on graphite related to electrode manufacturing—a move that analysts predict will lead to a decline in graphite exports from the country in the following years.

As for battery materials manufacturing, processed battery minerals are utilized to create battery components that can vary widely depending on the chemical makeup of the battery. For instance, a conventional lithium-ion battery cell typically comprises a graphite anode, a lithium-based cathode, and a lithium salt dissolved electrolyte. In 2022, China produced a staggering 85% of the world’s anodes, 82% of electrolytes, 74% of separators, and 70% of cathodes.

In terms of exports, China represented 74% of the world’s battery pack and component exports in 2023 and controlled nearly 85% of the global battery cell production capacity by value. The data indicates a clear pattern: China is not just participating in the global battery minerals market; it is, in many ways, defining it.

This comprehensive overview emphasizes China’s extensive influence and control throughout the entire battery minerals trade, significantly impacting global supply chains. As we navigate the future of energy solutions, particularly in light of growing demands for electric vehicles and renewable energy technologies, China’s role is likely to remain dominant and critical in this arena.

In conclusion, China is clearly the powerhouse in the global trade of battery minerals, demonstrating its dominance from mining to processing and manufacturing. With substantial control over major minerals critical for battery production—lithium, graphite, and cobalt—China is weaving an intricate web of influence in the realm of electric vehicles and energy storage solutions. This dominance is likely to grow as demand for these resources continues to escalate, shaping the future of the global battery market significantly.

Original Source: batteriesnews.com